Choosing an Investment Strategy

Most investment strategies involve significant doses of judgment, assumption and intuition. This is why there are so many different strategies. Just as artists create dramatically different works of art painting the same sunset, investment strategists draw dramatically different conclusions looking at the same data.

Unfortunately, while artists can create beautiful works of art despite dramatic differences, investment strategists are not so lucky. If one believes the market will be up this year and another believes it will be down, only one can be correct. This is why we believe it is not wise to use conventional investment strategies to achieve important financial goals.

An investment strategy should not be built on a foundation of judgment, assumption and intuition. An investment strategy to fulfill the lifetime goals of a family should be built on a foundation of sound engineering. Modern Portfolio Theory is such a foundation.

Risk and Reward

Modern Portfolio Theory is premised on the belief that investors are compensated for taking risks. Risk can be mitigated (but not avoided) through diversification. Therefore, an investor who builds a poorly diversified portfolio will be taking risks for which he expects no compensation. Take, for example, a single blue chip U.S. common stock. It has the same expected return as an entire portfolio of blue chip U.S. common stocks. However, a portfolio of one blue chip stock has much greater risk than a portfolio of one hundred blue chip stocks.

This is a difficult notion for many people to accept because the single stock portfolio has a much higher maximum return potential. But it also has a much higher maximum loss potential. Those offset each other and the expected return is the same for the single stock and the multiple stock portfolio. The greater maximum gain and loss potential is just a reflection of the greater risk.

Creating Wealth

Wealth can be reliably created over time with regular savings and a well-diversified portfolio. Wealth can be reliably maintained and grown over time with a well-diversified portfolio. Wealth cannot be created quickly with a well-diversified portfolio. Investors who have created wealth quickly using focused, poorly diversified portfolios have either applied judgment, assumption and intuition well or they have been lucky. It is impossible to differentiate the two. Naturally these investors will believe they have applied judgment, assumption and intuition well. Outsiders viewing their results will not be able to distinguish between skill and luck.

Professional Investors

It is even more difficult to distinguish luck from skill among professional investors. This is because they all have sophisticated methods and procedures. They can all describe their successful forecasts in great detail. However, having made a successful forecast and achieving a good result does not necessarily mean that the two are related or will be repeated.

Because poorly diversified portfolios have risk without compensation and it is impossible to identify professional investors who can mitigate this risk in advance, these portfolios are not suitable for achieving important financial goals.

Diversification Begets a Higher Probability of Success

With a well-diversified portfolio it is possible to develop a reliable plan with an extraordinarily high probability of success. This is because diversification removes a substantial element of uncertainty.

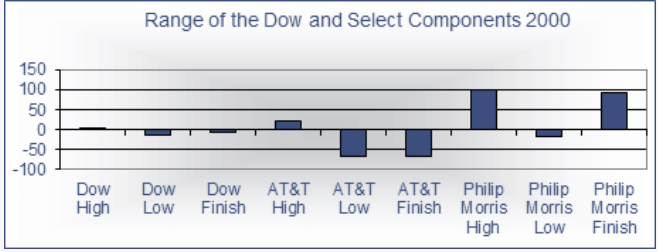

During calendar year 2000, the Dow Jones Industrial Average lost 6.18% of its value. At its high, the Dow was up 2%. At its lowest point, it was down 15%. Compare those results to AT&T and Philip Morris, which are two of the components of the Dow Jones Industrial Average. At its high, AT&T was up 20%. At its low, it was down 68%. Philip Morris was up 98% at its high. At its low, it was down 19%.

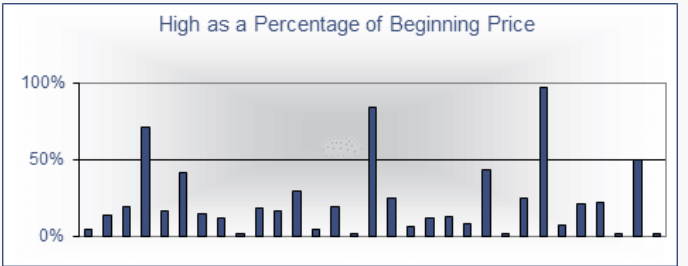

The following chart reflects the highest percentage gain achieved by every stock in the Dow Jones Industrial Average during the year 2000. Out to the right in green is the highest percentage gain the average itself reached.

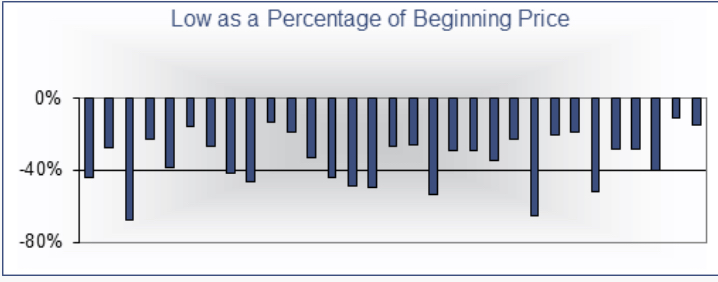

The next chart reflects the greatest percentage loss achieved by every stock in the Dow Jones Industrial Average during the year 2000. Out to the right in green is the greatest percentage loss the average itself reached.

The Dow Jones Industrial Average is made up of only thirty blue chip U.S. common stocks. Stocks in other assets classes lost much more in the year 2000.

Just diversifying among other U.S. blue chip common stocks dramatically reduced risk during the year 2000. Further diversification reduced risk even more. A more broadly diversified portfolio including small company stocks, value stocks, foreign stocks and real estate came close to breaking even in calendar year 2000.

The case for broad diversification was tough to accept for several years leading up to 2000. During that period, it seemed the less diversification, the better. Certainly many people with extremely focused portfolios made a lot of money prior to 2000. Many of those same people lost fortunes during 2000.

Harvesting Returns

Often individual investors shun broad diversification because they feel it can only achieve mediocre results. Nothing could be further from the truth. Broad diversification creates safety that allows us to increase risk in areas in which we are compensated for the risk we take.

Small cap stocks, value stocks and emerging markets are examples of asset classes that have risks for which we expect compensation. Broad diversification allows us to increase our allocation to these asset classes and potentially increase the expected return as a result. This increased expected return is not based on judgment, assumption or intuition. This potentially increased expected return is engineered based on decades of academic research.

Building a portfolio in this way creates a dramatic result that most people do not appreciate. A conventional portfolio may easily have total expenses of over 2% including management, trading and execution costs. On average these portfolios may achieve an average result of 11% before costs, or 9% net of costs. A portfolio engineered to achieve higher returns by exposure to risk factors for which compensation is expected on a broadly diversified basis can be expected to increase returns by more than 1% while keeping all costs below 1%. With this approach, a net return of 11% is a reasonable expectation. This is 2% higher than the expectation for the conventional portfolio.

At 9% per year, $1,000,000 will grow to $5,600,000 in 20 years (for illustrative purposes; based on information available at the time this was written). At 11% per year, $1,000,000 will grow to over $8,000,000. A $2,400,000 advantage is significant and it can be achieved with comparative safety through broad diversification.

Conclusion

The rewards from investing can be captured most consistently by creating a well-diversified portfolio that is engineered to optimize the risk/reward trade-off inherent in the stock market.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. Indices are not available for direct investment; therefore their performance does not reflect the expenses associated with the management of an actual portfolio. The index returns above assume reinvestment of all distributions. This information is for educational purposes only and should not be considered investment advice or an offer of any security for sale.