There are only two reasons to add an asset class to your portfolio. Either you want it to reduce risk or you want it to add return. Adding small cap stocks to a portfolio of large cap stocks can do both. Small cap stocks have provided returns with a different performance pattern than large cap stocks. In addition, small cap stocks have provided higher returns historically than large cap stocks.

What is a small cap stock?

To study small cap stocks we must first define the term “small cap”. Small cap is a reference to market capitalization. Market capitalization is the number of shares outstanding multiplied by the share price. A company with a billion shares outstanding and a share price of $50 would have a market capitalization of $50 billion. This would be considered a large cap stock. A company with a million shares outstanding and a share price of $50 would have a market capitalization of $50 million. This would be considered a small cap stock. Note that in this example the price per share is the same. While it is true that small cap stocks often have a lower price per share than large cap stocks, it is not always true and the price per share has no bearing on the definition of a small cap stock.

The definition of a small cap stock is not precise. Many refer to anything below $1 billion as small cap. Academic research suggests that small cap must be much smaller than that to capture the desired effect. Academicians define small cap stocks as those companies whose market cap is in the smallest 20% of the total market cap for all companies. These smallest of the small cap are sometimes referred to as micro-cap stocks.

A different performance pattern means diversification

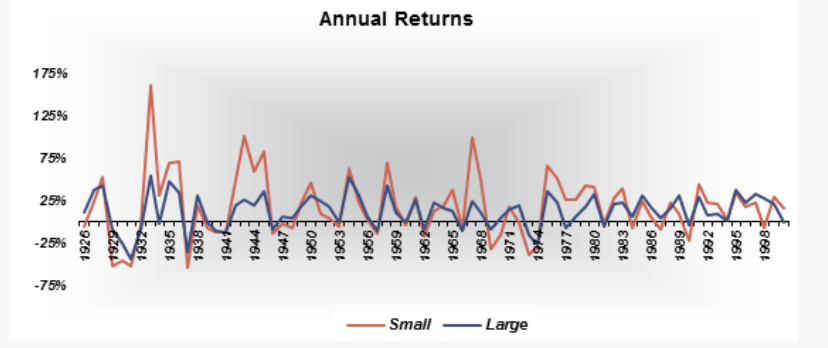

A different performance pattern means that small cap stocks go up and down by different amounts and at different times than other asset classes. The degree of this difference is called correlation. All US stocks are highly correlated with each other. However, anything less than perfect correlation creates a diversification effect. Small cap stocks are significantly more volatile than large cap stocks. They have higher highs and lower lows. Investors are compensated for enduring this volatility by earning a higher return. However, the diversified investor enjoys a bit of a “free lunch”. When combined with other asset classes, the diversification effect mitigates the higher volatility of small cap stocks such that the investor enjoys a higher return with minimal increase in risk, perhaps even a reduction in risk. The return patterns for small cap and large cap stocks are illustrated in the following graph.

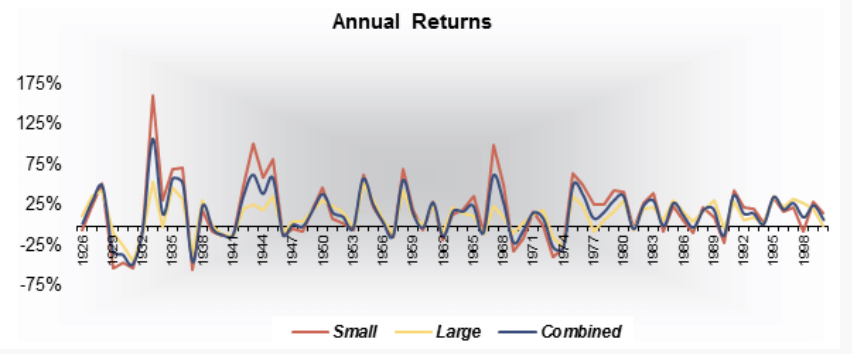

Diversification provides two positive effects: lower volatility and a higher return. Lower volatility comes as no surprise. Owning two asset classes that have different return patterns smooths out the performance spikes. The performance pattern of a portfolio invested 50% in small cap stocks and 50% in large cap stocks has lower highs and higher lows than small cap stocks alone. When combined with other asset classes the lows can be higher than the lows for large cap stocks.

When two asset classes with different return patterns are combined they will produce a return that is higher than the weighted-average of their individual returns if they are rebalanced periodically. This comes as a surprise to many investors. Take a look at this example.

From 1926 through mid September 2000 large cap stocks returned 11.47% and small cap returned 12.77%. The weighted-average of the large cap and small cap returns is 12.12% (11.47% + 12.77% = 24.24% divided by 2 = 12.12%). The weighted-average return can be boosted .56% to 12.68% by creating a 50-50 mix of small and large stocks and rebalancing annually. This is the diversification effect. This is a reliable effect. The two will always create a result that is greater than the sum of the parts. This is why we say that the diversification benefit is more important than the higher expected return. See the table below for the diversification benefit for other periods.

| 1926-2000 | 1933-2000 | 1945-2000 | 1973-2000 | 1982-2000 | |

|---|---|---|---|---|---|

| Large Cap Stock Returns | 11.47% | 13.16% | 13.54% | 14.32% | 19.43% |

| Small Cap Stock Returns | 12.77% | 16.87% | 14.60% | 15.58% | 16.04% |

| Weighted Average Expected Returns | 12.12% | 15.02% | 14.07% | 14.95% | 17.74% |

| Actual Returns | 12.68% | 15.51% | 14.44% | 15.33% | 18.01% |

| Diversification Benefit | 0.56% | 0.50% | 0.38% | 0.38% | 0.27% |

A higher expected return

The second benefit of including small cap stocks is that they have a higher expected return. Historically, small cap stocks have produced a higher return than large cap stocks. From 1926 through mid September of 2000 small cap returned 12.77% compared to 11.47% for large cap. You may ask: If the expected return is higher, why not allocate the entire portfolio to small cap? The answer is that there are long periods of time during which small cap stocks produce lower returns. However, there are also long periods of time during which large cap stocks produce lower returns than small cap stocks. The longer the period of time, the higher the probability small cap stocks will produce a higher return than large cap stocks.

These long periods of poor returns cause many investors to give up on their allocation to small cap stocks. The 1990s are a good example. From 1990 to 1999 small cap stocks returned 15.1% compared to 18.2% for large cap. However from January 1, 2000 through September 30, 2000 small cap stocks produced a return of 14.5% compared to large cap stocks that produced a negative return of –1.4%. There is no reliable way to identify the future periods when small cap will outperform large cap. The gains are often dramatic and swift. A consistent allocation to small cap must be maintained to capture the benefit.

Finding the right allocation to small cap stocks

To capture a meaningful benefit from including small cap stocks in the portfolio it is necessary to include a weight that is substantially greater than would result from just matching their respective market cap weightings. If we included small cap in proportion to overall market cap weighting, the effect would be to diminish small cap stocks to the point that the impact of the benefit of small cap stocks is negligible.

Aggressive investors, on the other hand, can make a case for heavily weighting small cap stocks for the purpose of developing a higher expected return. However, these investors do so at the cost of an increased short-term risk. Small cap stocks have under-performed large cap stocks for periods of as long as 17 years! We advocate adding small cap stocks to the portfolio only to the point that minimizes volatility.

In the long run having a consistent allocation to small cap stocks creates a higher expected return. It is true that over any given period there is no guarantee that small cap stocks will produce a higher return than large cap stocks. However, it is also true that in the long run there is a greater than 50% probability that small cap stocks will produce a higher return than large cap stocks.

Consistently including a meaningful allocation of small (micro) cap stocks in a portfolio for the long-term should significantly increase the return without a significant increase to risk.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. Indices are not available for direct investment; therefore their performance does not reflect the expenses associated with the management of an actual portfolio. The index returns above assume reinvestment of all distributions. This information is for educational purposes only and should not be considered investment advice or an offer of any security for sale.