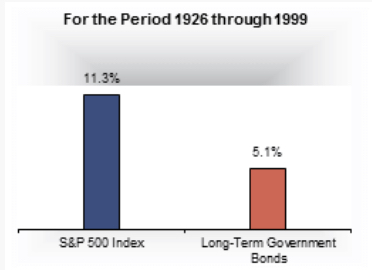

At Resource Consulting Group, we believe in using strictly short-term bonds in building the fixed income portion of portfolios. To explain why, we must begin by asking, “Why do we invest in bonds in the first place?” Historically, common stocks have returned 11.3% per year on average while bonds have returned 5.1% on average. Why include bonds in our portfolio if we expect to earn 6% less than stocks? The answer, of course, is safety.

While it is true that stocks have returned 11.3% per year on average, bad years have produced losses of more than 40%. In addition, there have been periods of more than 10 years during which stocks have produced a negative rate of return. An important strategy for successful investing in stocks is to hang on when their values plummet. Bonds provide the safety net that allows investors to ride out the ups and downs of the stock market.

But why are bonds less risky? When you buy stock you buy equity in a company. You hope the company will produce a profit and grow in value. But the results are uncertain, so you expect to be compensated for this uncertainty with a higher rate of return. When you buy bonds you lend your money in exchange for interest income. You receive a promise of scheduled payments and accept a lower rate of return. Bonds are often secured so the uncertainty is greatly reduced.

Here is an example of the use of bonds. Mrs. Moneypenny is retired. She has a portfolio of $1 million and spends $60,000 a year. She invests $600,000 in a diversified portfolio of stocks and $400,000 in bonds. If her stock portfolio drops 25% in value she can live off the interest and principal of her bonds and her stock dividends for over 10 years. It is likely that her stock portfolio would recover in that time.

There have been very few 10-year periods since 1926 during which stocks have produced a negative return. From 1929 through 1938 common stocks lost 0.9% per year. That is not as bad as it sounds since there was deflation of 2% during that period. By owning bonds, Mrs. Moneypenny would have been able to ride out the Great Depression with minimal impact on her spending. Even investors who have more than 15 years until retirement may be uncomfortable investing only in stocks. Bonds can add stability and safety to their portfolio.

Now that we have established that we own bonds for safety, we must determine the most efficient way to invest in bonds to achieve this result. Today’s bonds come in many shapes and sizes. They are often much more risky than they seem. Generally, bonds carry three risks: credit risk, interest rate risk and inflation risk. Mortgages and bonds with call provisions also carry pre-payment risk. Convertible bonds may carry some of the risk of the stocks into which they are convertible. Lower quality “junk” bonds also carry some of the risk of the stock of the company issuing them. To varying degrees all these risks increase with bond maturity, i.e., the length of time you must wait to get your principal returned. Each risk has the potential to reduce the effectiveness of bonds in the portfolio.

To illustrate the huge importance of the bond term, consider the following example. An interest rate move from 6% to 7% would cause a 30-year Treasury zero coupon bond to decline in value by almost 25% while a one-year Treasury Bill would decline by less than 1%. Short-term bonds are inherently more stable. Any change in the interest rate has less effect on them because they will mature shortly. Investors can rely on short-term bonds to hold their value through even the worst markets.

This example shows how much greater the impact of interest rate risk is on long-term bonds. There is also a greater chance that credit risk will impact long term bonds and, if it does, the impact will generally be more severe. Inflation risk is not significant in short-term bonds since inflation takes years to become significant. Long-term bonds, on the other hand, can be devastated by inflation. Investors who owned long-term bonds in the late 70’s and early 80’s were destroyed by the combined effect of inflation and interest rates.

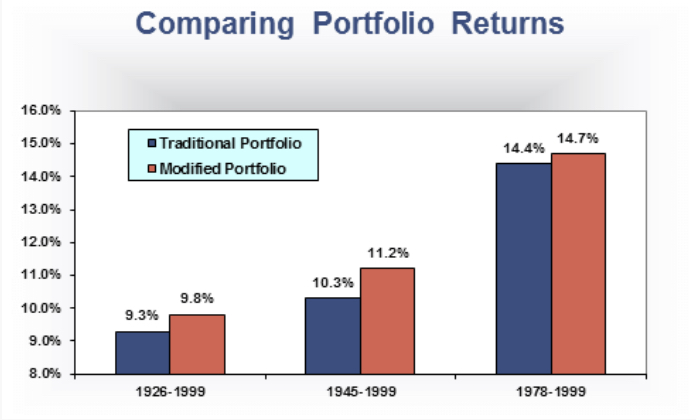

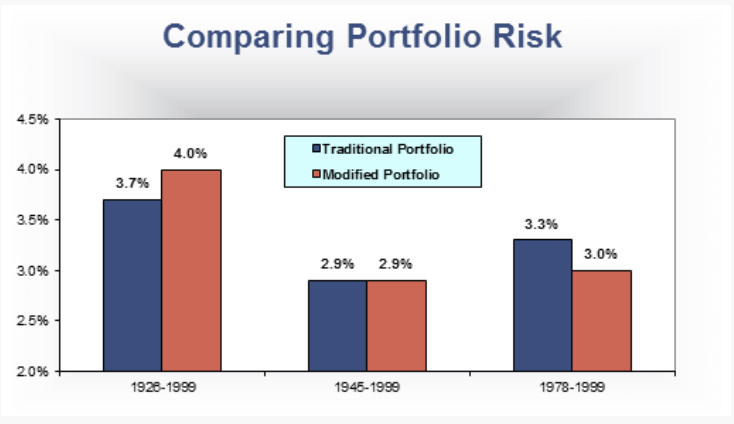

Many studies have been done to quantify the risk and return from combining short and long-term bonds with different asset classes of stocks. Because of the number of variables and the time-periods used to ascertain rates of return and risk, the results differ. In the graphs below we show the return and risk for two sample portfolios:

- Traditional portfolio – 40% long-term bond, 60% US common stock

- Modified portfolio – 30% short-term bond, 70% US common stock

Note that in every period the return of the modified portfolio is higher.

- In the 1926 through 1999 period, the risk of the modified portfolio is slightly higher

- In the 1945 through 1999 period, the risk is the same

- In the 1978 through 1999 period, the risk is lower

We consider the last time period most relevant since it reflects a far different bond market than existed prior to changes in U.S. monetary policy.

By using the modified portfolio, we expect to enjoy slightly higher returns with slightly lower risk. More importantly, we believe that it is useful to have a portion of the portfolio that is truly stable and can be tapped regardless of market conditions. The combination of these results makes a strong case for using only short-term bonds for the fixed income portion of the portfolio.

We believe investors are not well compensated for the risk added by long-term bonds. Long-term bonds are much riskier than most investors realize. The purpose of bonds in a portfolio is to mitigate risk and long-term bonds do not achieve this objective. Increasing the allocation to equities and using short-term bonds instead of long-term bonds increases investment returns more efficiently. In addition, short-term bonds provide a practical means by which to meet spending needs in bad markets.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. Indices are not available for direct investment; therefore their performance does not reflect the expenses associated with the management of an actual portfolio. The index returns above assume reinvestment of all distributions. This information is for educational purposes only and should not be considered investment advice or an offer of any security for sale.